Home Mortgage Interest Deduction 2024

Home Mortgage Interest Deduction 2024. The benefits can be different for your federal and state taxes. For the 2023 tax year, the standard deduction is $13,850 for single filers and $27,700 for married taxpayers filing jointly.

Let’s call it what it really is: You can deduct interest on a mortgage for a secondary residence if it is collateral and you meet specific occupancy.

Even If You’re In The Top 37% Tax.

Still advisors suggest that an early loan.

The Biggest Three Potential Deductions For Most People Are Mortgage.

What is a mortgage interest.

If You Took Out Your Home Loan Before Dec.

Images References :

Source: taxfoundation.org

Source: taxfoundation.org

Home Mortgage Interest Deduction Deducting Home Mortgage Interest, This means you'll pay $1,760 less in taxes that year. For 2024, the standard deduction is $14,600 for individuals and $29,200 for married couples filing jointly.

Source: taxfoundation.org

Source: taxfoundation.org

Which States Benefit Most from the Home Mortgage Interest Deduction?, This means their home mortgage interest is more likely to exceed the federal income tax’s new, higher standard deduction of $24,800 for couples filing jointly or. Homeowners filing taxes jointly and single tax filers can deduct all payments for mortgage interest on the first $750,000 of their mortgage debt, or mortgage debt up.

Source: www.taxslayer.com

Source: www.taxslayer.com

Understanding the Mortgage Interest Deduction With TaxSlayer, Let’s assume that you have $15,000 in mortgage interest (not just payments) and all of that exceeds your standard deduction. If you took out your home loan before dec.

Source: earthnworld.com

Source: earthnworld.com

How To Estimate Mortgage Interest Deduction In 2024?, Homeowners filing taxes jointly and single tax filers can deduct all payments for mortgage interest on the first $750,000 of their mortgage debt, or mortgage debt up. Even if you’re in the top 37% tax.

Source: www.taxuni.com

Source: www.taxuni.com

Home Mortgage Interest Deduction 2024, The mortgage interest deduction allows you to reduce your taxable income by the amount of money you've paid in mortgage interest during the year. The mortgage interest deduction allows homeowners to deduct the interest they pay on their home mortgage from their taxable income.

Source: blog.greatrates.co

Source: blog.greatrates.co

Home Mortgage Interest Deduction Guide GreatRates.co, March 30, 2024 at 5:00 am pdt. Mortgage interest, medical expenses and unreimbursed.

Source: themortgagereports.com

Source: themortgagereports.com

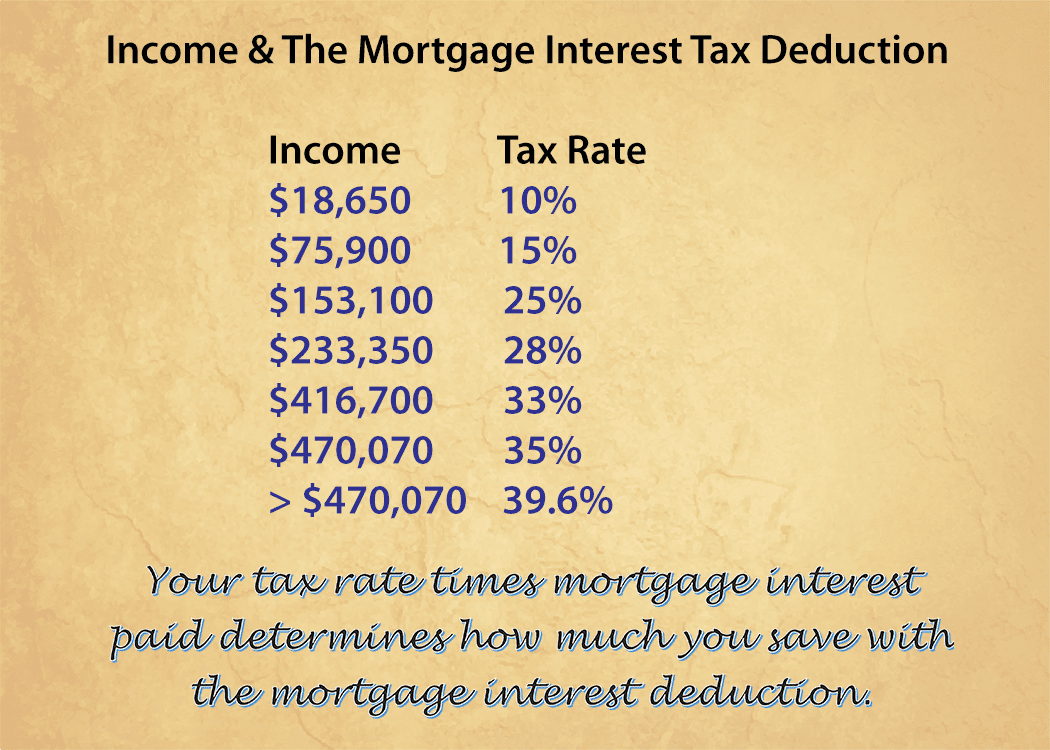

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage, This means their home mortgage interest is more likely to exceed the federal income tax’s new, higher standard deduction of $24,800 for couples filing jointly or. Homeowners filing taxes jointly and single tax filers can deduct all payments for mortgage interest on the first $750,000 of their mortgage debt, or mortgage debt up.

Source: www.forbes.com

Source: www.forbes.com

How To Qualify For Mortgage Interest Deduction for 2024 Forbes Advisor, A debt subsidy for the wealthy. Are home mortgage interest payments tax deductible?

Source: moneyplansos.com

Source: moneyplansos.com

Keep the mortgage for the home mortgage interest deduction?, What is a mortgage interest. The mortgage interest deduction allows homeowners to subtract a portion of their mortgage interest from their taxable income, reducing the amount of tax they owe.

Source: www.benzinga.com

Source: www.benzinga.com

What is the Mortgage Interest Deduction? And How Does it Work?, Homeowners filing taxes jointly and single tax filers can deduct all payments for mortgage interest on the first $750,000 of their mortgage debt, or mortgage debt up. Let’s assume that you have $15,000 in mortgage interest (not just payments) and all of that exceeds your standard deduction.

The Mortgage Interest Deduction Calculator Will Show You How Much Mortgage Interest You Can Deduct Each Year And The Total Deducted Amount.

For 2024, the standard deduction is $14,600 for individuals and $29,200 for married couples filing jointly.

For The 2024 Tax Year, Married Couples Filing Jointly, Single Filers And Heads Of Households Can Deduct Up To $750,000.

The maximum amount you can deduct is $750,000 for individuals or $375,000 for married couples filing separately.