Max Bonus Depreciation For 2024

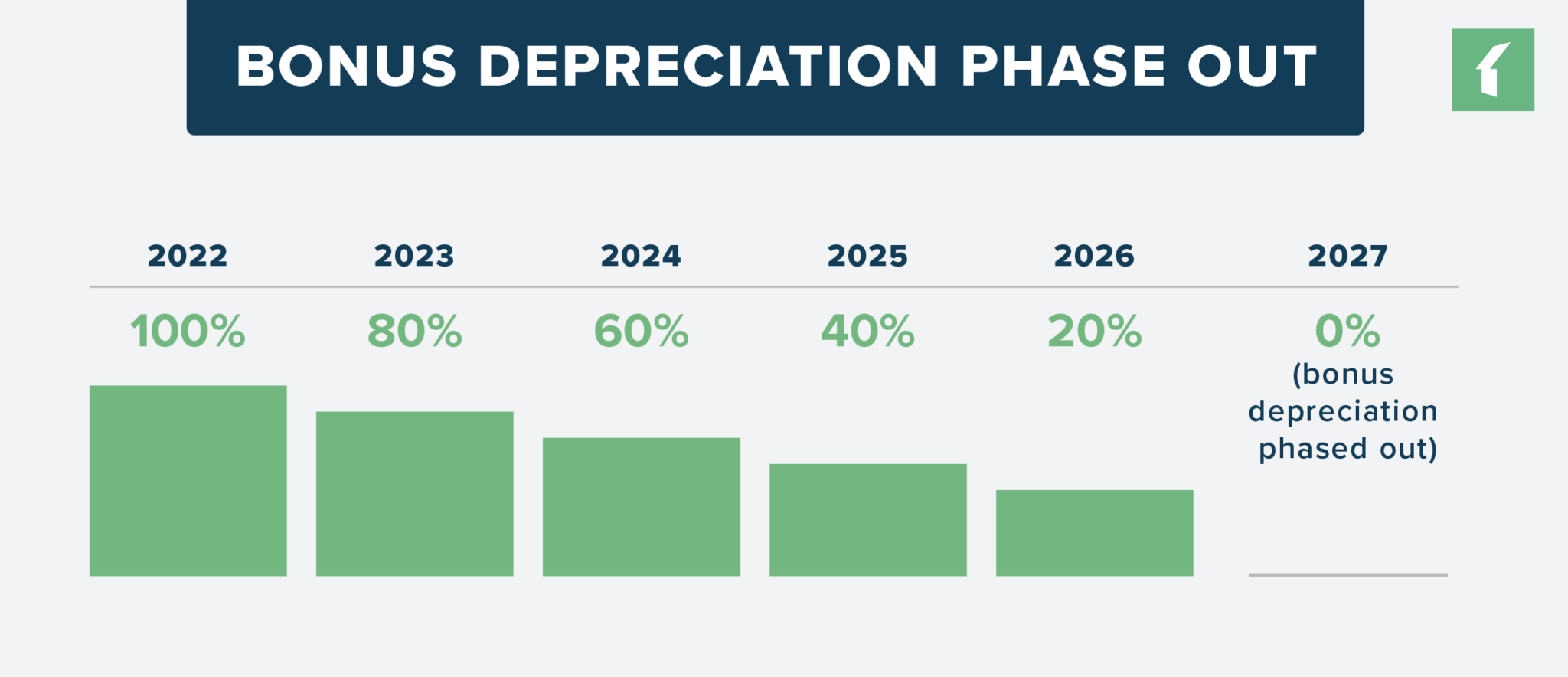

Max Bonus Depreciation For 2024. The legislation, dubbed the tax relief for american families and workers act of 2024, extends 100% bonus depreciation for eligible qualified property for qualified property placed in service after december 31, 2022, and before january 1, 2026 (january 1, 2027, for longer production period property and certain aircraft [1].) But percentage of business use dictates the maximum value of bonus depreciation that can be claimed.

But percentage of business use dictates the maximum value of bonus depreciation that can be claimed. The proposed legislation would increase the amount of the deduction to $1.29 million beginning in 2024 with the phaseout increased to $3.22 million.

Bonus Depreciation Is Optional—You Don't Have To Take It If You Don't Want To.

40% for property placed in service after december 31, 2024 and before january 1, 2026.

Bonus Depreciation, Which Is Generally Taken After The Section 179 Spending Cap Is Reached, Will Continue To Phase Down From 80% In 2023 To 60% In 2024.

It begins to be phased out if 2024 qualified asset additions exceed $3.05 million.

One Of The Most Significant Provisions Of The Tax Cuts And Jobs Act (Tcja) Was Increased Bonus Depreciation For Qualified Property Placed Into Service Between Sept.

Images References :

Source: sailsojourn.com

Source: sailsojourn.com

8 ways to calculate depreciation in Excel (2024), Bonus depreciation is optional—you don't have to take it if you don't want to. Bonus depreciation continues to ramp down in 2024.

Source: alisblorianne.pages.dev

Source: alisblorianne.pages.dev

Business Auto Depreciation 2024 Sibyl Deloris, But percentage of business use dictates the maximum value of bonus depreciation that can be claimed. Bonus rate is 20% january.

Source: www.buildium.com

Source: www.buildium.com

Bonus Depreciation Saves Property Managers Money Buildium, Bonus depreciation deduction for 2023 and 2024. 20% this schedule shows the percentage of bonus depreciation that businesses can claim for eligible assets in each year.

Source: www.bank2home.com

Source: www.bank2home.com

Bonus Depreciation Calculation Example Ademolajardin, Bonus depreciation, which is generally taken after the section 179 spending cap is reached, will continue to phase down from 80% in 2023 to 60% in 2024. Without this retroactive treatment, bonus depreciation would be 80% in 2023 and 60% in 2024.

Source: www.linehaul.info

Source: www.linehaul.info

100 Bonus Depreciation Extended in 2024, How does bonus depreciation differ from section 179 deductions? 179 deduction for tax years beginning in 2024 is $1.22 million.

Source: leeannlogan.blogspot.com

Source: leeannlogan.blogspot.com

Irs macrs depreciation calculator LeeannLogan, Here’s why you need to take advantage before its phased out. Specific provisions in the bill:

Source: haipernews.com

Source: haipernews.com

How To Calculate Depreciation Deduction Haiper, The rate of bonus depreciation continues to phase down, with eligible assets acquired and placed in service in 2024 eligible for 60% bonus depreciation before it decreases further in subsequent years. The 100% bonus depreciation phased out after 2022, with qualifying property getting only a 60% bonus deduction in 2024 and less in later years.

Source: www.financialfalconet.com

Source: www.financialfalconet.com

How to Claim Bonus Depreciation Financial, Bonus depreciation decreased for 2024. But percentage of business use dictates the maximum value of bonus depreciation that can be claimed.

Source: www.energy.gov

Source: www.energy.gov

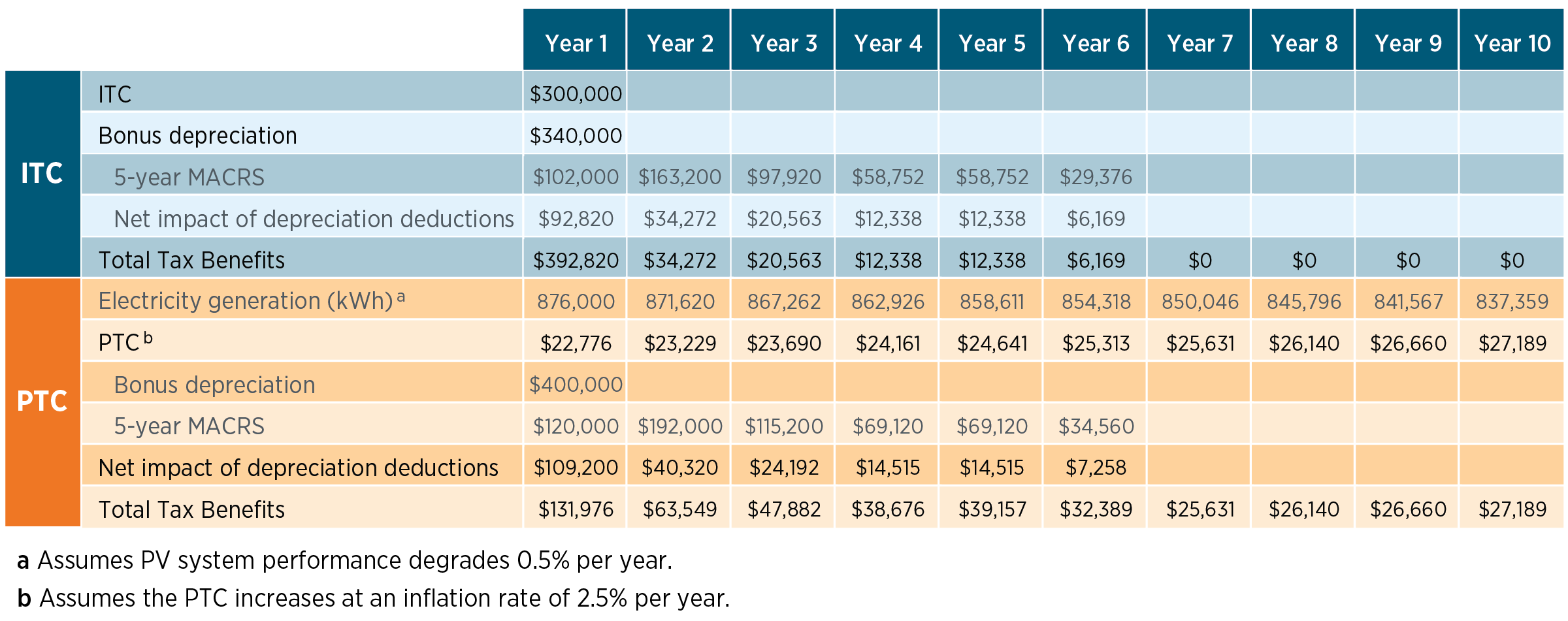

Federal Solar Tax Credits for Businesses Department of Energy, First, bonus depreciation is another name for the additional first year depreciation deduction provided by section 168 (k). The legislation, dubbed the tax relief for american families and workers act of 2024, extends 100% bonus depreciation for eligible qualified property for qualified property placed in service after december 31, 2022, and before january 1, 2026 (january 1, 2027, for longer production period property and certain aircraft [1].)

Source: investguiding.com

Source: investguiding.com

Bonus Depreciation vs. Section 179 What's the Difference? (2024), Bonus depreciation deduction for 2023 and 2024. By beacon funding | mar 7, 2024 | 1184 views.

Specific Provisions In The Bill:

20% for property placed in service after december 31, 2025 and before january 1, 2027.

Bonus Depreciation Is Lowered Again This Year.

Bonus depreciation continues to ramp down in 2024.